Why is a credit score/report important?

A credit score and report give you a detailed report on your credit health. Open accounts, balances, loans, employment history, credit history, and more are detailed in the report. To the consumer, credit reports can help determine fraud or check overall creditworthiness. A lender uses the score and report to make a judgment about the reliability of the borrower. When applying for a mortgage or car loan, the lender will use the score to determine things like interest rates.

What is a credit report?

A credit report is a breakdown of an individual’s credit history. Credit reports are given by a credit bureau—a business that collects financial information. There are three major credit bureaus: Equifax, Experian, and TransUnion. Lenders (such as a bank or credit union) use this credit report to determine how likely an applicant is to repay a loan.

The report includes previous addresses, employment history, credit cards, credit history, and bank accounts. Getting a credit report can help borrowers detect fraud. A sudden change in a credit score may indicate fraudulent action or identity theft!

There are two different types of credit inquiries:

- A hard inquiry is a complete evaluation of your credit history—triggered by applying for credit cards—and negatively affects the applicant's credit score.

- A soft inquiry provides less information and does not affect the applicant's score. Soft inquiries are some free credit reports, loan prequalification, background checks, etc.

What is a credit score?

A credit score is a numerical summary of a credit report. There are several different credit scoring systems, but the most commonly followed is the FICO score. A score of below 580 is considered poor, while a score above 800 is exceptional. The score helps borrowers and lenders make quick decisions about loans.

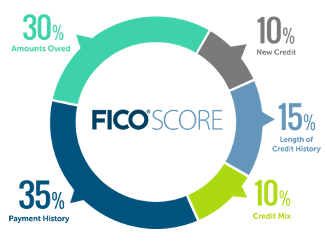

The score is determined through:

- Payment history: Most importantly, the score is calculated through previous accounts. If a borrower has consistently paid credit balances on time, their score will increase. (makes up 35 percent of your score)

- Amounts owed: If a borrower is using a lot of their balance, they are considered to be overextending and may be considered risky. (30%)

- New credit: Multiple credit accounts opened in a short period represent higher risk. (10%)

- Credit history: The length of time a borrower has used an account generally increases scores. The amount of time between the oldest card, newest card, and usage are combined to determine this section. (15%)

- Credit mix: FICO evaluates a mix of cards, retail accounts/services, outstanding loans, mortgages, and finance company accounts. (10%)

Source: myFICO

How do I get a free credit report?

Alternatively, you can contact one of the three major credit bureaus directly. The Fair And Accurate Credit Transactions Act (FACTA) assures that once every 12 months consumers can check their credit report. One of the easiest websites to use is AnnualCreditReport.com, which is sponsored by the three bureaus. This will not include the numerical FICO score associated with your report.

You can also receive a free credit report if you have been the victim of fraud or denied credit.

How do I check my credit score for free?

Getting a hold of the three number score is more difficult than the report. One of the most widely accessible ways is through your bank or credit union’s monthly statement or online portal. Participating companies are Bank of America, Citibank, Discover, HSBC, Key Bank, Merrick Bank, Navy Federal Credit Union, PenFed Credit Union, Sallie Mae, SunTrust, Union Bank, and Wells Fargo.

You have probably seen advertisements for websites or apps that give out credit scores for free. Some of these sites are safe to use, while others are looking to scam users. It is important to note that the following websites do not give a true FICO score, but rather a consumer credit score. However, they are still a good indicator of credit health and can help you make financial decisions.

Some of the most reputable websites are

- CreditKarma.com

- CreditSesame.com

- Credit.com

If it is essential to check your score, you can purchase one from myFico.com for minimal cost.

Should I pay for a credit score or report?

While the FICO score is a great estimate, it is not necessary to monitor your credit with it. Free consumer credit scores and regularly checking your credit report will give you a good understanding of credit health. If you feel that a consumer credit score and free report are not enough, it may be helpful to purchase one or sign up for a continual credit monitoring program.

Suspecting Fraud

If your credit score drops suddenly, it may be fraud! Make sure to report it and get a credit report immediately. There are several steps you can take with the FTC.

Sources, Links, and Further Reading

Credit Reports:

Credit Scores:

Fraud/Identity Theft:

Free Credit Reports:

Free Credit Score Checks: